The Crime and Safety Blind Spot: Are smash-and-grabs really closing businesses?

This is part of the “Crime and Safety Blind Spot” series, which presents an opportunity to understand various perspectives, entertain new ones, and consider different conclusions. Read the introduction and view other posts here.

INTRODUCTION

Some argue that rampant organized retail crime—often referred to as “smash-and-grabs”—are devastating businesses, endangering workers and consumers, and crippling the economy, and they demand harsher penalties to deter these brazen crimes. Others insist that blaming retail theft for business closures is an exaggerated distraction from other issues like social inequities and lingering pandemic impacts. In this post, we will explore various views, studies, and solutions related to organized retail crime.

| PERSPECTIVES FROM THE LEFT | PERSPECTIVES FROM THE RIGHT |

| “Organized retail […] crime increased over 25% across the country last year, and we’re seeing criminals become more aggressive and violent while they’re stealing from our stores, putting both customers and employees at risk. Our bipartisan Combating Organized Retail Crime Act will go after these large-scale criminal schemes and help law enforcement work with the retail industry to deter, detect, and prosecute these crimes.” –Sen. Catherine Cortez Masto (D-Nev.) “We’ve doubled down on our efforts to combat crime with millions of dollars to deter, arrest and successfully prosecute criminals involved in organized retail theft. This year, shopping centers across California will see saturated patrols as [California Highway Patrol] regional teams work with local law enforcement agencies to help make arrests and recover stolen merchandise.” –Gov. Gavin Newsom (D-Calif.) | “Stores throughout American communities have not been spared from a national crime wave. These organized theft rings have been developing new tactics to pilfer goods, causing economic harm to American businesses and putting consumers at risk while funding transnational criminal organizations throughout the world. These criminals are exploiting the internet and online marketplaces to stay one step ahead of the law, and it’s time the law catches up.” –Sen. Chuck Grassley (R-Iowa) “By putting criminals over communities, families, and small business owners, hardworking Americans across the country are being forced to pay the financial and emotional costs of these failed policies. Amid an unprecedented spike in retail crime, reports also suggest many professional shoplifters or boosters are part of a much larger organization of criminals—including transnational criminal organizations […] that are taking advantage of our open borders.” –Rep. August Pfluger (R-Texas) |

EXPLORING KEY PERSPECTIVES AND BLIND SPOTS

What are the smash-and-grab crime trends?

Smash-and-grabs can be charged in different ways depending on the nature of the crime.

- Shoplifting: Stealing goods from a retail store

- Burglary: Illegally entering a building with the intent to steal

- Robbery: Using force or intimidation to take property directly from a person

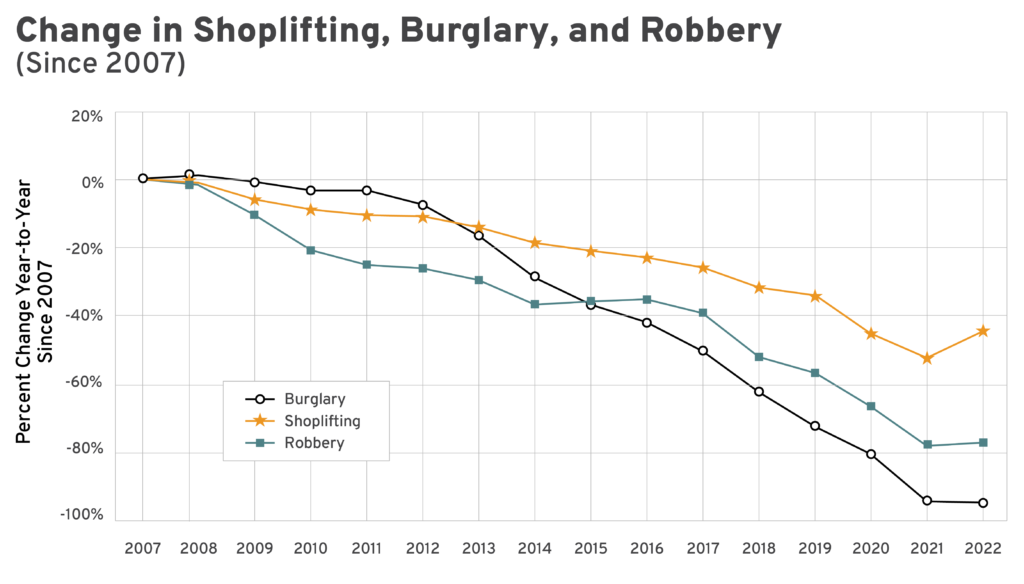

The following charts provide a nationwide view of these crime rates from 2007 to 2022.

Source: Federal Bureau of Investigation

| States with Highest Felony Theft Threshold | States Most Impacted by Retail Theft (per capita) |

| $2,500: Texas, Wisconsin | Washington |

| $2,000: Colorado, Connecticut, Pennsylvania, South Carolina | Maine |

| Hawai‛i | |

| Pennsylvania | |

| New Hampshire | |

| States with Lowest Felony Theft Threshold | States Least Impacted by Retail Theft (per capita) |

| $950: California | Wyoming |

| $900: Vermont | Idaho |

| $750: Florida, Hawai‛i, Indiana | Mississippi |

| Georgia | |

| Alabama |

Potential Blind Spot: Determining the total impact of smash-and-grabs can be challenging. Organized retail crime is generally classified through investigations rather than charged offenses, making it difficult to track crime data accurately. Further, nearly three-quarters of all thefts go unreported. While some suggest that raising the theft threshold has fueled an increase in retail crime, crime rates have remained relatively steady across states, regardless of whether they raised the threshold.

What is the impact of smash-and-grabs?

- From 2018 to June 2023, shoplifting followed the same downward trends as other property crimes (with the exception of motor vehicle theft, which saw a substantial increase) and has remained below pre-pandemic levels.

- Target, Walgreens, Whole Foods, and Nordstrom have claimed they had to close stores due to retail theft. Retail closures negatively impact workers, reduce foot traffic leading to lower sales, and can drive up prices.

- According to one recent survey, 50 percent of retail workers have witnessed a theft or attempted theft; 33 percent have experienced violent situations involving customers; and 40 percent feel scared to go to work.

Potential Blind Spot: While some cities—such as New York City, Los Angeles, and Dallas—have seen a significant increase in theft, property crimes have declined in most other cities. Regardless, news footage and viral videos of smash-and-grabs fuel public perception. Could this heightened attention be driven more by visibility than reality? In 2023, 78.1 percent of retailers expressed organized retail crime as more of a priority than a year ago. This issue is often linked to “shrink,” or unsold inventory loss, estimated at $100 billion annually. However, only about a third of these losses are attributed to customer theft, raising questions about the true impact of retail crime. Some experts also argue that it is nearly impossible to verify claims that organized retail crime caused shrinkage, and some CEOs have even admitted to overstating its impact.

Who is committing organized retail crime?

- Research shows that 58 percent of organized retail crime is committed through cargo theft rather than smash-and-grabs, and only 38 percent happens in-store.

- The vast majority of retail theft—more than 95 percent—involves only one to two people, and only 0.1 percent involves more than six.

- Research shows that 28.5 percent of retail theft is committed by employees.

Potential Blind Spot: From 2019 to 2021, the share of cases lacking information on the number of offenders increased from 16 percent to over 25 percent, highlighting a growing gap in data. Additionally, stores catch shoplifters only around 2 percent of the time. This limited enforcement and incomplete data make it difficult to accurately assess the true scope and nature of those involved in organized retail crime, which can make it harder to prevent. It would be valuable to understand how often lower-level offenders are apprehended in contrast to the key figures or “kingpins” orchestrating organized retail crime. This insight could help refine enforcement strategies and ensure efforts target those driving these criminal operations rather than just the individuals carrying out smaller thefts.

What are the recent criminal justice efforts to prevent smash-and-grabs?

- At least 30 states have enacted organized retail crime laws that allow prosecutors to aggregate the value of stolen goods over a specified period, thereby enabling harsher penalties. California is one of the latest to enact such laws.

- A recent survey found that 98 percent of small retail business owners have adopted anti-theft measures, with the most common being price increases and the second security cameras. Other efforts include body cameras for employees.

- Congress passed the Inform Consumers Act in 2023, which requires online marketplaces to disclose high-volume seller identities to deter the organized sale of stolen goods. The proposed Combating Organized Retail Crime Act would allow federal charges with harsher penalties when the value of stolen goods exceeds $5,000 over a 12-month period. It also aims to improve retailer and law enforcement collaboration by offering a better way to track trends.

Potential Blind Spot: Theft and organized retail crime are driven by different motives, so addressing them likely requires distinct approaches. Lessons from the drug trade suggest that targeting the “kingpins” behind organized crime is more effective than focusing on low-level offenders, who are easily replaced. Similar to how harsher drug laws did not reduce availability, blanket penalties may not deter organized retail crime. Instead, a focus on aggregating thefts and disrupting the leadership of these networks could better combat the issue. There is a lack of research on protective measures businesses can implement to deter theft and organized retail crime.

R STREET’S PERSPECTIVE

While smash-and-grab incidents have gained attention in a few high-profile cities, overall property crimes—including retail theft and burglaries—have generally declined across most of the United States. Despite the media focus, the actual scale of the problem is hard to gauge due to underreporting, inconsistent tracking of organized retail crime, and inventory shrinkage data that often aligns more with cargo and distribution center thefts than with smash-and-grabs. In some cities, organized retail crime is a genuine and growing concern that demands attention for long-term prevention. However, smash-and-grabs remain a relatively small percentage of total property crime, violent crime, or even business losses.

There is growing bipartisan agreement on the need to treat organized retail crime differently from simple shoplifting. By reclassifying organized retail crime distinctly and separately from shoplifting, states and cities may have better opportunities to develop targeted strategies to address them. Methods for combating organized drug rings, such as focusing on the leaders rather than just the small offenders, could provide valuable insights for effectively tackling organized retail crime.

Addressing organized retail crime requires a coordinated effort between law enforcement, retailers, and policymakers, as broad strategies for all theft are less effective than targeted, data-driven approaches specific to organized crime. Recent bipartisan efforts at the federal level mark a promising step forward. However, businesses can also play a bigger role in combating shrink by adopting best practices from companies like Lowe’s, which has minimized inventory loss through well-trained, fairly compensated staff. This combination of collaboration and proactive business strategies could be key to tackling the issue effectively.