PJM Capacity Auction Reveals Market Advantages and Room for Improvement

The PJM Interconnection, a regional transmission organization serving parts of the eastern United States, conducts capacity auctions to ensure a reliable supply of electricity. These auctions supplement spot market revenues to procure the necessary resources to meet expected future demand. Recent rule changes and market dynamics have significantly impacted auction outcomes, particularly in pricing and resource participation.

Stakeholders have voiced rising concerns over grid reliability given tightening supply-demand conditions. Capacity auctions have signaled such scarcity via rising prices, prompting concerns over excessive consumer costs. Importantly, regional capacity auctions with competitive suppliers remain advantageous to meet reliability needs at the lowest cost relative to the likely alternative: utility-specific capacity planning under cost-of-service rates. Compared to fragmented utility planning, research shows that capacity market parameters accurately reflect the type and location of resources needed to satisfy reliability criteria. They also harness competitive forces to achieve reliability needs at lower cost and risk than monopoly utilities through well-designed market rules, sufficient participation, and oversight to mitigate any potential market power issues.

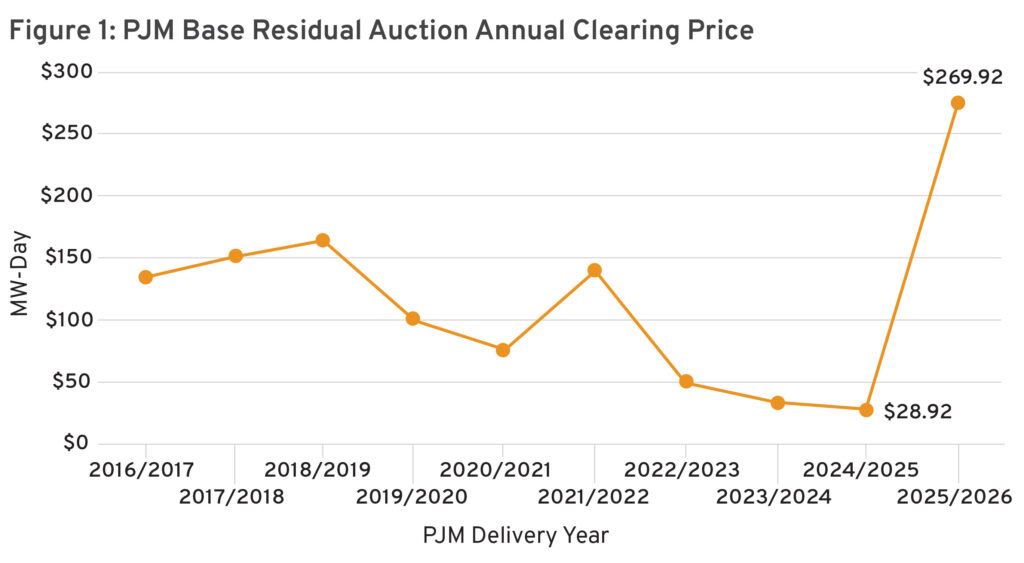

Clearing prices significantly increased in the July 2024 capacity auction compared to previous years. Contributing factors include rising fuel costs, expanding demand, mounting restrictions on new supply, generation retirements, and capacity auction rule changes. Prices increased most in Maryland and Virginia, where locational constraints on the transmission system—including significant load growth and generation retirements—are reflected in the capacity market.

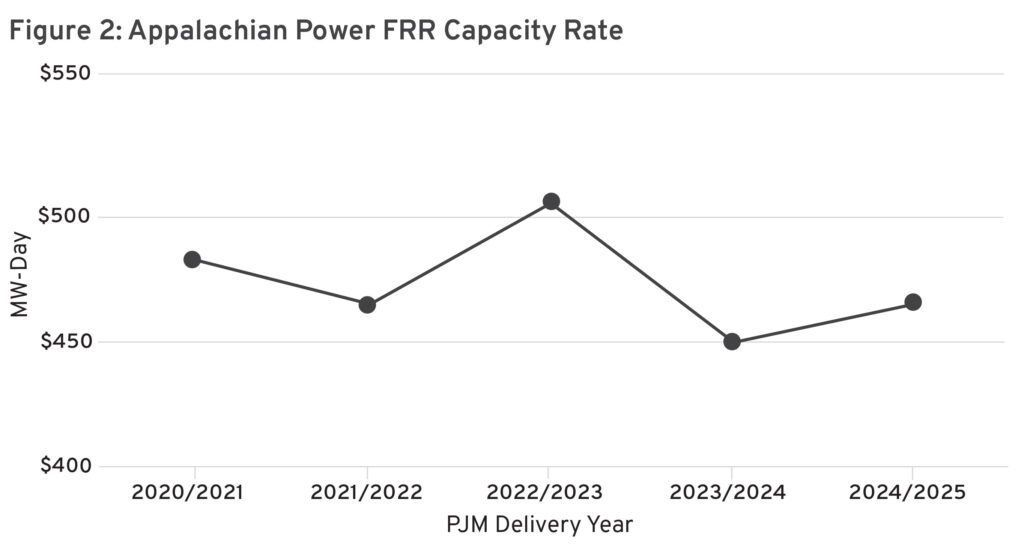

PJM consists of restructured states, whose demand is met by the market, and monopoly states, whose demand is decided by regulatory cost-of-service administration and whose utilities usually participate in PJM using a fixed resource requirement (FRR). A comparison of PJM’s capacity market prices with FRR cost-of-service prices highlights the efficiency of competitive markets. Vertically integrated utilities using the FRR alternative, such as Appalachian Power, typically have higher costs due to limited competition and suboptimal resource allocation. In contrast, PJM’s Base Residual Auction (BRA) clearing prices demonstrate how competitive forces promote cost efficiency, even under challenging system conditions.

In an effort to enhance market efficiency and reliability, PJM has implemented several key rule changes in its capacity auction framework over the years. One of the most notable adjustments is the modification of capacity performance rules to be more responsive than previous rules that allowed resources to commit with less stringent penalties for non-performance during critical events at peak demand periods, ensuring that resources are not only available but also capable of delivering electricity when it is needed most. Another important change is the integration of demand response resources into the capacity market. This shift with recent adjustments aims to recognize the role of consumer behavior in managing electricity demand, with the idea of allowing demand side resources to participate alongside traditional generation sources to create a more balanced and flexible capacity market. These nuanced rule changes led to increased auction prices and underscore the increased complexity of the energy landscape. There are valid critiques of various PJM rule changes, and an overarching strategy toward greater revenue reliance from spot markets over capacity markets is warranted; however, such improvements are beyond the scope of this piece.

A key takeaway is that PJM’s markets are well equipped to provide ample investment signals and to procure resources more cost-effectively than cost-of-service mechanisms. While generators acknowledge receiving a clear build signal from the latest auction results, markets will not build what governments do not allow. Artificial restrictions on supply raise concerns about resource sufficiency beginning in the late 2020s.

New supply restrictions stem from numerous factors. PJM took roughly four years to process interconnection requests and, in 2022, paused review of new requests until 2026. Meanwhile, new generators face rapidly escalating state permitting and siting restrictions in addition to stricter federal environmental rules. Market participants are finding some creative workarounds, including efficient bilateral deals that net out in the capacity market, but long-term reliability concerns may ultimately emerge as the result of policies that undermine markets.

As the market adjusts to recent rule changes, demand growth, and the consequences of barriers to new investment, PJM has decided to delay its next auction by six months to work on further potential reforms. However, the increased participation of demand response and renewable resources may further influence price dynamics. Higher prices in the capacity auction reflect not only the cost of securing reliable electricity but also the market’s response to evolving energy needs. As PJM stakeholders navigate these changes, the ongoing evolution of the capacity market will be crucial in meeting the demands of a dynamic energy future.

The lessons for PJM stakeholders are to trust and enhance the market model. PJM states reliant on cost-of-service utilities, such as West Virginia and Virginia, should consider options to let more consumers shop for power in the competitive marketplace. States that adopted the market model, such as Ohio and Pennsylvania, should listen to PJM’s market monitor, consumers, and independent analysis to remain resolute on the market advantage and dismiss rent-seeking requests from utilities to re-regulate. All states benefit from more efficient market design rules, and resolving artificial barriers to new supply to ensure markets achieve reliability at least cost should be top priority.