Testimony Before the Senate Budget Committee’s Hearing on “Risky Business: How Climate Change Is Changing Insurance Markets”

Submitted Statement of

Jerry Theodorou

Director of Finance, Insurance and Trade

R Street Institute

Hearing on

“Risky business: how climate change is changing insurance markets”

Before the

Committee on the Budget

United States Senate

March 22, 2023

Chairman Whitehouse, Ranking Member Grassley, and distinguished Senators:

Thank you for the opportunity to offer testimony on how climate change is affecting insurance markets. This issue is important for providers and buyers of insurance protection because climate change alters the patterns of natural catastrophes, contributing uncertainty to an industry whose role is to provide stability and protection from loss.[1] (The term “catastrophe” as used throughout is defined as a natural event causing at least $25 million in insured property losses.) The insurance and reinsurance industries provide coverage from losses from sundry climate events. To the extent that climate change impacts the frequency and severity of climate-related losses, reinsurers must recalibrate their products. There is broad consensus among reinsurers that the climate is changing in ways that aggravate the occurrence of catastrophic events.[2] The reinsurance industry therefore has a major role to play in responding and developing solutions to our changing climate.

I am the director of Finance, Insurance and Trade program at the R Street Institute (RSI). I conduct independent research on public policy issues that impact buyers of property and casualty (P&C) insurance, such as flood insurance, crop insurance and emerging risks. Prior to joining R Street in 2021, I was an insurance industry analyst at insurance asset management and industry research firm Conning, where I studied financial conditions as well as the market and external forces impacting insurance and reinsurance company performance.

RSI is a nonprofit, nonpartisan public policy research organization whose mission is to engage in policy research and outreach to promote free markets and limited, effective government. The issues covered in today’s hearing are particularly relevant to RSI because at its founding in 2012, RSI’s signature issue was climate change and its impact on property and casualty insurance and reinsurance. Weeks after RSI’s founding, it characterized climate change as a “high salience issue” and appealed to readers’ “common sense.”[3] Climate change and resilience are and will continue to be among the most consequential issues of the day.

I would like to address three questions at the heart of today’s hearing.

- What is the impact of climate on the insurance and reinsurance industries?

- What is the financial condition of the insurance industry, and can it withstand deleterious impacts of climate change?

- How is the insurance industry changing in response to climate change?

Impact of Climate Change

The P&C insurance industry is, and has been, in the business of providing weather insurance. When wind, fire, hail and other natural hazards cause billions of dollars in property damage, the insurance industry acts as the economy’s first responder, paying claims and helping customers get back on their feet.

When extreme weather events cause damage to homes and businesses insurers are not shocked. Property insurance is designed to cover such events; insurance policies contractually protect insurance buyers from such loss events; and insurers are capitalized sufficiently to meet their claims obligations. When losses from catastrophes are large, in the billions or tens of billions of dollars, insurers are cushioned with financial protection in the form of reinsurance, the shock absorber of the insurance industry. Insurers design their reinsurance purchases to limit the losses borne on their balance sheet, allowing insurance companies to maintain their own financial stability, while providing stability to their customers.

Insurers keep an eye on climate and weather patterns because they largely price their policies on the basis of past loss events. Because the past is not necessarily prologue, insurers consider changes in the frequency and severity of loss events, and recalibrate their pricing every year to get the appropriate amount of premium according to risk magnitude. If they underprice, they suffer financially; if they overprice, they eventually lose business to competitors who step in to provide coverage at lower, risk-adjusted rates. The U.S. property and casualty insurance industry is highly competitive, with over 3,000 insurers, ranging in size from large publicly-traded national giants to regional insurers. At the smaller end, there are hundreds of one-state, multi-county and single county mutual insurance companies.[4]

Reinsurance is also a competitive industry. There are major centers for reinsurers in continental Europe; among Lloyd’s syndicates with an appetite for U.S. reinsurance risk; numerous Bermuda-based reinsurers; as well as U.S. reinsurers, the largest being Berkshire Hathaway’s National Indemnity Company. And just as primary insurers limit their losses with reinsurance, reinsurers buy retrocessional reinsurance from other capital providers so that their balance sheets can withstand large losses. The broader insurance industry thus provides three layers of protection: primary insurance from insurance companies; reinsurance; and retrocessional reinsurance. These three layers make the reinsurance industry exceptionally stable. To illustrate, in 2010, in the wake of the great recession, there were only eight insurance company impairments, on par with the long-term average.[5] This compares to 157 bank failures in 2010.[6]

The exceptionally low failure rate of P&C insurers is due in large part to the emphasis they place on capital management, deploying enterprise risk management, asset liability management and stress testing, in addition to the three layers of protection described above. It is this dedication to shepherding their capital that has enabled many insurers and reinsurers to operate for over a century. For example, the first modern professional reinsurance company, Cologne Re, was founded in 1846 as a response to the great Hamburg fire of 1842.[7] Another European giant reinsurer, Munich Re, was founded in 1880. Some U.S. mutual insurers have been operating since the early 1800s and before, and are still going strong.[8] To survive and thrive for over a century, an insurer must be a good steward of its capital and a reliable provider of a quality product to its customers.

Financial Condition of Insurers

The current financial position of the insurance industry is good. In the last five years, 2002 was only year when P&C insurers had an underwriting loss—where loss is the sum of losses and expenses exceeding premium—which was largely because of claim cost inflation. Supply chain shortages, combined with deteriorating driving behavior, conspired to raise the cost of automobile repairs.[9] The 2022 combined ratio for private auto insurance was 101.2 percent, approximately ten percentage points higher than in 2021, as a result of poorer driving, more fatalities and higher auto repair costs. But even in 2022, the investment income contribution to insurers’ bottom line made for acceptable operating results.

The P&C insurance industry’s balance sheet has strengthened in the past half-decade. The industry’s surplus (the extent to which assets exceed liabilities) rose from $757 billion in 2018 to $1.05 trillion in 2021.[10] The combined ratio was below 100 percent in 2018 – 2021, and rose to 102.5 percent in 2022, largely from higher costs for automobile physical damage losses, due also to shortages of spare parts and labor shortages, leading to higher losses.

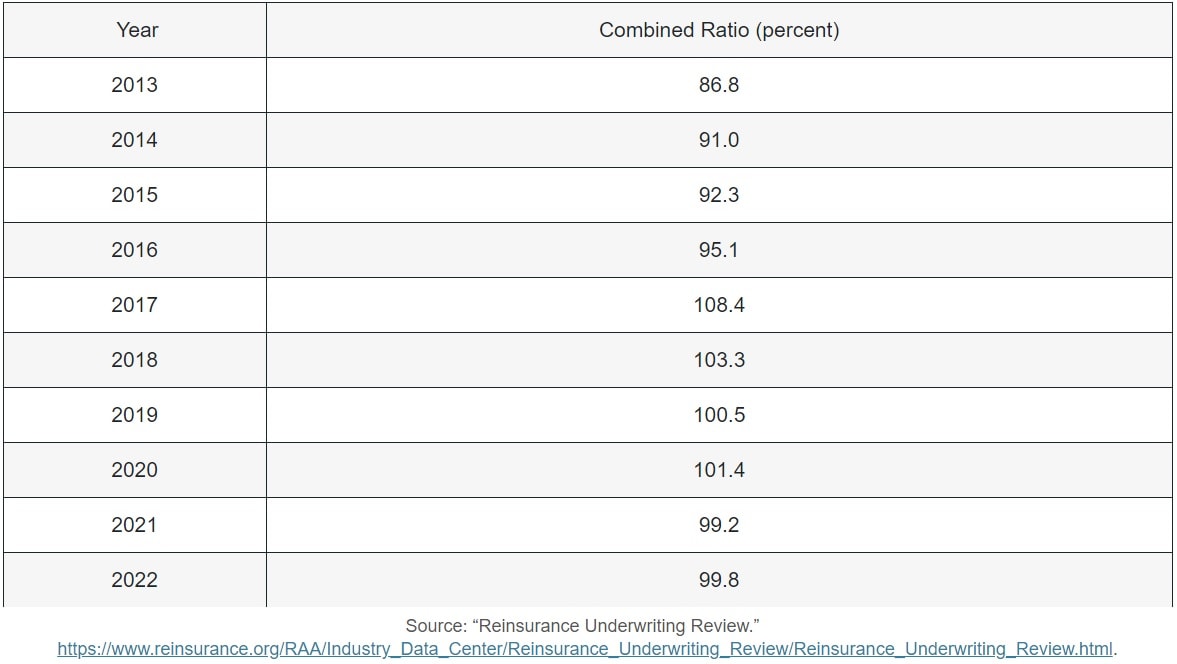

The reinsurance industry is also financially strong. Historical data on U.S. reinsurance performance shows the industry has delivered healthy underwriting results through 2022. In most years in the past decade, the underwriting result has been profitable, as shown in the Table 1 below.[11] A combined ratio below 100 percent indicates underwriting profit. When investment income, equivalent to approximately 10 percentage points, is added to the underwriting result, all 10 years saw an operating profit—even 2017, the year of hurricanes Harvey, Irma and Maria in the United States and the Caribbean.[12]

Table 1: U.S. Reinsurance Combined Ratio

How is the insurance industry changing in response to climate change?

The insurance and reinsurance industries are responding to climate change in two broad ways: by encouraging insurance buyers to take measures to mitigate loss potential; and by structuring new products.

Measures to mitigate losses and make properties more resilient include discounts offered to property owners who make their structures more capable of withstanding the perils of wind, hail, rain or hail. The 17,000-acre Babcock Ranch community in southwest Florida provides an example of how much loss potential is reduced when homes are strengthened to withstand natural catastrophe losses.[13] Homes in Babcock Ranch were designed to the strictest building codes. The community is sited in an area at no risk from storm surges and has native landscaping for absorption of water and underground power cables. While hurricane Ian destroyed the nearby cities of Naples and Fort Meyers in 2022, the only losses at Babcock Ranch were a few fallen trees. There was no loss of power.

Florida insurers make available discounts for residential properties that use construction materials or techniques to reduce the risk of storm damage.[14] Discounts are available for fortification measures to withstand hurricane force winds by strengthening and securing roofs and shutters and garage door reinforcement. There are also sales tax exemptions for impact-resistant doors, garage doors and windows.

Insurers may also provide credits to communities that establish a natural barrier between a body of water and buildings. RSI has written on this, supporting the Coastal Barriers Resources Act (CBRA) and its expansion.[15] RSI found that “natural infrastructure can also do a better job weathering the effects of storms and flooding than engineered structures.”[16] Natural barriers are features of the surrounding environment that mitigate risks from severe weather events, such as powerful convective storms or floods. Natural barriers may take the form of mangroves, coral reefs and marshes. It has been shown that only 15 feet of marshland can absorb half the power of storm surge.[17] Mangroves can also reduce impacts from storm surges. One study found that 330 feet of mangrove trees “can reduce wave height by 66 percent.”[18]

In California, insurers offer premium discounts to homeowners and businessowners who make their properties safer from wildfires.[19] Measures may include installation of sprinkler systems and building with fire-resistant materials and designs for walls and roofs.

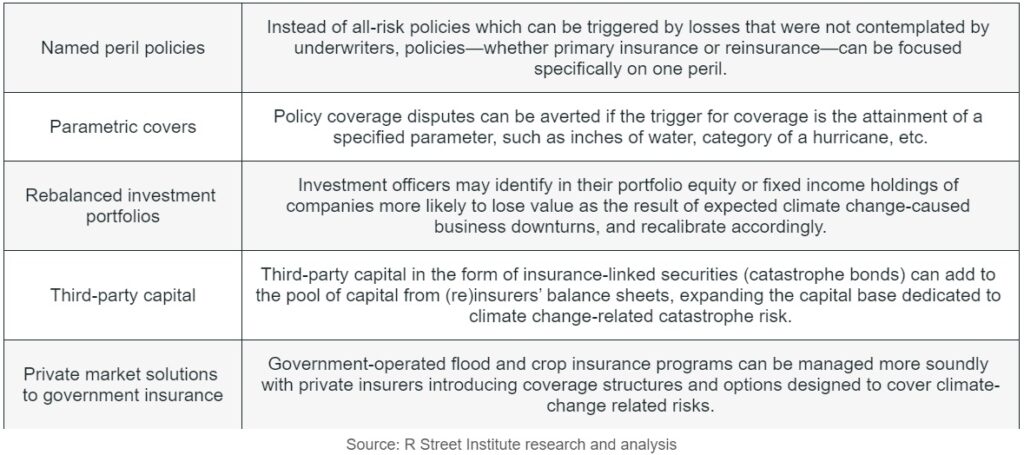

Other ways reinsurers are responding to climate change involve adjustments to their business models. Five such responses include changing from all-risk policies to named peril policies; introducing parametric covers; rebalancing investment portfolios; attracting third-party capital; and offering private market policies that were insured with government programs.

Climate Risk

There is an established link between anthropogenic climate change and extreme weather event frequency and severity. Although the data points to a higher frequency of high-severity extreme events, forecasts cannot be made with precision because of the complex interplay of climate change factors.[20] There is consensus in the scientific and insurance communities that more extreme events are to be expected. While modeling confidence and precision is improving, we cannot articulate the specific magnitude and times of the changes.

The profile of physical climate risk is dynamic, spatially heterogenous and incremental on the timeframe of relevance to insurance markets. For example, many climate science studies focus on natural hazards at the end of the century, whereas the reinsurance market is focused on the near term.[21] Climate change does not present a near-term “shock” risk to financial markets akin to pandemics, wars or housing crises despite posing a high magnitude risk to society over the very long term.

The granularity and complexity of climate risk is ripe for a bottom-up market approach to risk management. Policymakers can help markets manage climate risk organically through actions like transferring risk responsibility to the private sector, removing barriers to capital flows seeking diversification and correcting moral hazard problems. One example is fixing distortive subsidies in the National Flood Insurance Program to permit private market pricing at an actuarially sound rate.[22]

Conclusion

Ignoring climate change is not an acceptable response. Climate sceptics are not found in the fundamentally conservative insurance industry, whose job is to restore things to how they were. We acknowledge those who call for waking up to the reality of climate change—insurers have acknowledged it for many decades. Insurance markets have an appetite for climate risk, are in the business of dealing with it, and will continue to play a key role in absorbing and mitigating its risk to our economy.

Thank you again for the opportunity to testify before you today. I look forward to addressing your questions.

[1] “Facts and Statistics: U.S. Catastrophes,” Insurance Information Institute, last accessed March 17, 2023. https://www.iii.org/fact-statistic/facts-statistics-us-catastrophes.

[2] “The Potential Impact of Climate Change on Insurance Regulation,” National Association of Insurance Commissioners, 2008. https://content.naic.org/sites/default/files/legacy/documents/cipr_potential_impact_climate_change.pdf.

[3] Eli Lehrer, “Climate silence: It’s just common sense,” The R Street Institute, Oct. 31, 2012. https://www.rstreet.org/commentary/climate-silence-its-just-common-sense.

[4] “Property, Casualty and Direct Insurance in the United States—Number of Businesses 2004-2029,” IBIS World, Jan. 25, 2023. https://www.ibisworld.com/industry-statistics/number-of-businesses/property-casualty-direct-insurance-united-states/#:~:text=There%20are%203%2C708%20Property%2C%20Casualty,increase%20of%200.6%25%20from%202022.

[5] “Best’s Impairment Rate and Rating Transition Study – 1977 to 2011,” A.M. Best Company, March 26, 2012. https://www.ambest.com/nrsro/impairment.pdf.

[6] “Bank Failures in Brief – Summary 2001 to 2023,” Federal Deposit Insurance Corporation, last accessed March 17, 2023. https://www.fdic.gov/bank/historical/bank.

[7] David Holland, “Reinsurance: A brief history,” The Actuary, Sept. 21, 2012. https://www.theactuary.com/archive/old-articles/part-3/2012/09/21/reinsurance-brief-history.

[8] “The Philadelphia Contributionship: A New Startup 270 Years Ago,” The Philadelphia Contributionship, May 14, 2022. https://1752.com/2022/05/14/the-philadelphia-contributionship-a-new-startup-270-years-ago.

[9] Tim Zawacki, “US P&C industry statutory combined ratio tops 100% for 1st year since 2017,” S&P Global Market Intelligence, March 13, 2023. https://www.spglobal.com/marketintelligence/en/news-insights/research/us-pc-industry-statutory-combined-ratio-tops-100-for-1st-year-since-2017#:~:text=13%20Mar%2C%202023-,US%20P%26C%20industry%20statutory%20combined%20ratio%20tops,for%201st%20year%20since%202017&text=A%20run%20of%20underwriting%20profitability,released%20statutory%20financial%20results%20reveals.

[10] S&P Capital IQ Pro, last accessed March 17, 2023. https://www.capitaliq.spglobal.com/web/client?auth=inherit#news/home.

[11] “Reinsurance Underwriting Review,” Reinsurance Association of America, last accessed March 17, 2023. https://www.reinsurance.org/RAA/Industry_Data_Center/Reinsurance_Underwriting_Review/Reinsurance_Underwriting_Review.html; “Quarterly Underwriting and Operating Report,” Reinsurance Association of America, last accessed March 17, 2023. https://www.reinsurance.org/quarterly.

[12] Chris Vaccaro, “Extremely active 2017 Atlantic hurricane season finally ends,” National Oceanic and Atmospheric Administration, Nov. 30, 2017. https://www.noaa.gov/media-release/extremely-active-2017-atlantic-hurricane-season-finally-ends.

[13] Renee Cho, “With Climate Impacts Growing, Insurance Companies Face Big Challenges,” Columbia Climate School, Nov. 3, 2022. https://news.climate.columbia.edu/2022/11/03/with-climate-impacts-growing-insurance-companies-face-big-challenges.

[14] “Financial Incentives,” Fortified, last accessed March 17, 2023. https://fortifiedhome.org/incentives.

[15] Portia Mastin and Jerry Theodorou, “Congress must act to solve an urgent crisis on our coasts,” The Hill, July 25, 2022. https://thehill.com/opinion/energy-environment/3571637-congress-must-act-to-solve-an-urgent-crisis-on-our-coasts; Josiah Neeley and Tony Carvajal, “Be prepared: using Florida’s natural infrastructure to combat climate change,” R Street Shorts No. 124, March 2, 2023. https://www.rstreet.org/research/be-prepared-using-floridas-natural-infrastructure-to-combat-climate-change.

[16] Neeley and Carvajal. https://www.rstreet.org/wp-content/uploads/2023/03/r-street-short-no-124-co-branded-FINAL-1.pdf.

[17] Heather Luedke, “Fact Sheet: Nature as Resilient Infrastructure – An Overview of Nature-Based Solutions,” Environmental and Energy Study Institute, Oct. 16, 2019. https://www.eesi.org/papers/view/fact-sheet-nature-as-resilient-infrastructure-an-overview-of-nature-based-solutions#:~:text=Natural%20infrastructure%20%E2%80%93%20Projects%20that%20use,%2C%20and%20social%20co%2Dbenefits.

[18] Ibid.

[19] Hayley Smith, “California to require insurance discounts for property owners who reduce wildfire risk,” Los Angeles Times, Oct. 17, 2022. https://www.latimes.com/california/story/2022-10-17/state-to-mandate-insurance-discounts-for-wildfire-mitigation.

[20] Guillen Barroso, “‘All Models are Wrong, but Some are Useful.’ George E.P. Box,” last accessed March 17, 2023. https://www.lacan.upc.edu/admoreWeb/2018/05/all-models-are-wrong-but-some-are-useful-george-e-p-box.

[21] Anja T. Rädler, “Invited perspectives: how does climate change affect the risk of natural hazards? Challenges and step changes from the reinsurance perspective,” Natural Hazards and Earth System Sciences 22:2 (March 2022), pp.659-664. https://nhess.copernicus.org/articles/22/659/2022.

[22] R. J. Lehmann, “Do No Harm: Managing Retreat by Ending New Subsidies,” R Street Policy Study No. 195, February 2020. https://www.rstreet.org/wp-content/uploads/2020/02/195.pdf.