How states use occupational licensing to punish student loan defaults

Authors

Key Points

Media Contact

For general and media inquiries and to book our experts, please contact: pr@rstreet.org

Introduction

In recent years, college graduates have found themselves increasingly saddled with student loan debt. Even worse, many of these graduates fall behind on that debt—sometimes through no fault of their own. Prolonged illness, divorce, job loss or other unexpected life events can all cause those living from paycheck-to-paycheck to temporarily default on their loan obligations.

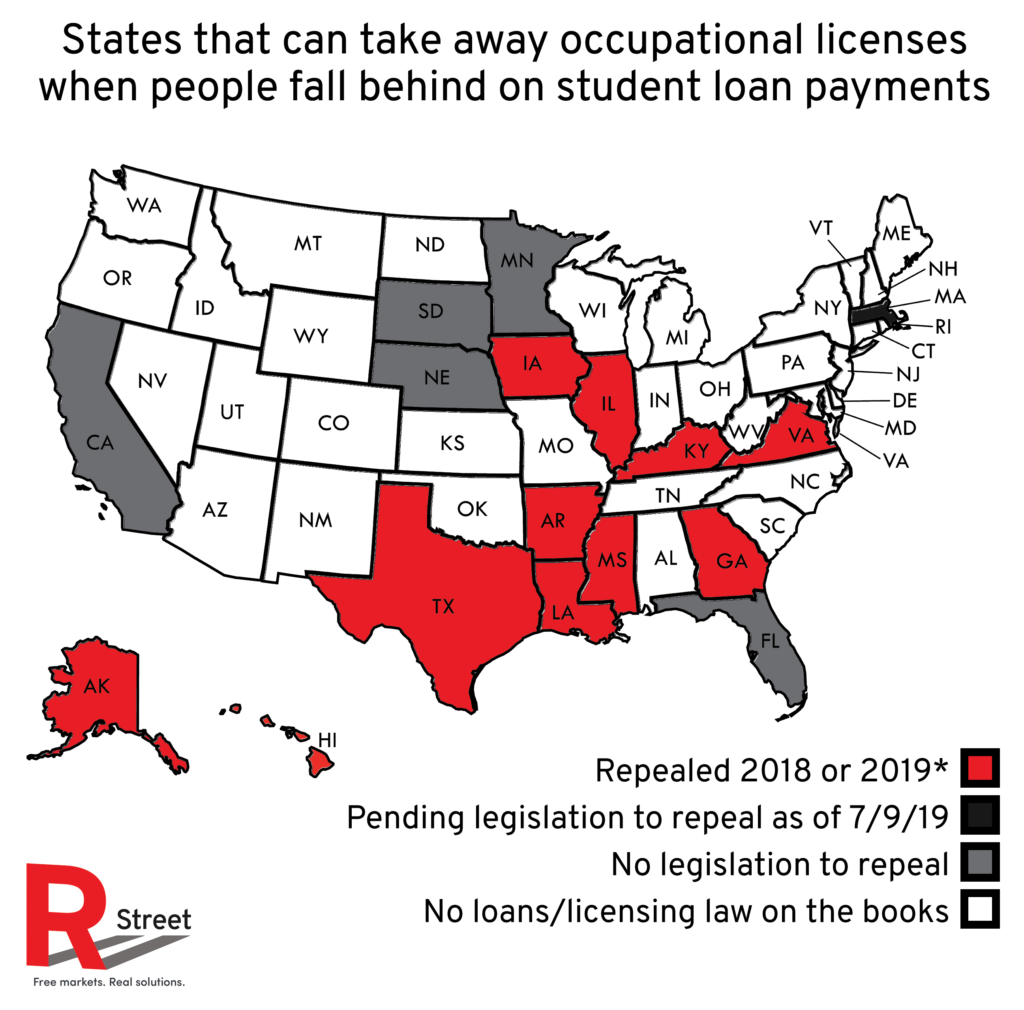

While defaulting on a student loan can bring a whole host of unpleasant ramifications—from wage garnishments to liens—it can also become a direct threat to a person’s livelihood. Presently, 18 states have laws on the books that allow them to strip occupational licenses from individuals who have defaulted on student loans. Certain states enforce these laws more vigorously than others but the laws put borrowers in a lose-lose situation, as they take away a person’s primary means of income and thus their ability to repay outstanding debt.

It is difficult to measure the extent to which states are using these laws against borrowers but the evidence that is available suggests it is a widespread practice. Despite some claims to the contrary, revoking or suspending professional licenses on account of defaulting on a student loan is a self-defeating policy that leaves borrowers worse of than before. Moreover, these laws can actually work to thwart more traditional debt collection tools, including wage garnishments.

By using occupational licenses in the service of debt collection, lawmakers make licensure an even more harmful labor market constraint. At the same time, it also distracts from more nuanced and narrowly targeted solutions for addressing the recent rise in student loan debt. Ultimately, lawmakers need to require licensing boards to become more transparent about the extent to which they are using these license revocation laws. There also needs to be a concerted effort to repeal and remove these laws in states where they exist.

Read the full study here.